Aug 29, 2024 | News

Strategic analysis of emerging cryptocurrencies

Hunting for the next major gain in the volatile world of crypto? This post dives deep into the strategic evaluation of cryptocurrencies that are showing strong potential for explosive growth. By dissecting key indicators like market trends, trading volumes, and technological advancements, we’ll explore which digital assets are likely to outperform. Our analysis reviews the emerging tokens that are making waves and could be on the brink of a significant breakout. Whether you’re looking to expand your portfolio or find that one hidden gem, understanding the strategic landscape of these emerging cryptocurrencies could be your key to achieving remarkable returns.

Top 5 analyst-backed cryptocurrency picks

The cryptocurrency market is teeming with options, but which ones truly stand out among the sea of digital assets? With an overwhelming number of coins entering the market almost daily, it can be challenging for investors to identify those with genuine potential. Fortunately, leading analysts have done the heavy lifting, sifting through market data to provide insight into the top five cryptocurrencies that could generate extraordinary returns this month. From projects with cutting-edge technologies to tokens backed by robust networks, these five selections are poised to make significant moves.

The first crypto on our radar is Kaspa (KAS). Currently trading between sixteen and eighteen cents, it has shown remarkable resilience, despite a slight pullback over the past month. With critical resistance levels at twenty-one cents and an RSI nearing 70, experts predict a potential surge of up to 275% if these resistance levels are breached. Investors see Kaspa’s strong community support and its unique technological offerings as key catalysts for this expected growth.

Next up, Avalanche (AVAX) has caught the attention of analysts, who are closely watching its performance around the .26 to .82 price range. Although this coin has experienced some declines recently, it remains above critical support at .58. Market watchers highlight that if AVAX breaks past the .69 resistance level, it could nearly double, with a price target of .00—equating to a potential gain of 250%. This coin’s strong foundation in DeFi and extensive developer adoption make it a standout option.

Another standout is Render (RENDER), trading within the five to seven-dollar range. Recently, Render has gained significant traction, climbing 19% over the past week alone. Analysts are optimistic about its chances to reach the mark in the near term, which would result in a 220% gain. Looking further ahead, a longer-term target of .00 suggests a possible 300% increase from current levels. Render’s unique utility in facilitating decentralized GPU rendering undeniably positions it as a key player in the digital asset arena.

Cronos (CRO) also makes the top five with its current trading price fluctuating between [gpt_article topic=””September’s Top 5 Analyst Recommendations: Cryptocurrencies That Could Maximize Your Investment by 25x”” directives=”Format the text for embedding in a WordPress post, using HTML tags. Reword the

Looking for the next big crypto opportunity? This article delves into the top five digital currencies that could potentially amplify investments by 25 times this September. Featuring expert insights and analysis, it highlights the coins poised for dramatic growth. Discover which cryptocurrencies may skyrocket and why they stand out in the market.

Kaspa (KAS)

Kaspa is currently trading between sixteen and eighteen cents, with resistance at nineteen cents and support at fourteen cents. Despite a recent drop of approximately fourteen percent over the past month, the coin has shown a positive five percent increase recently. With moving averages stabilizing around seventeen cents and an RSI close to 70, Kaspa is primed for a potential breakout. If the bulls drive the price beyond the twenty-one cent mark, Kaspa could potentially surge by up to 275%, making it a compelling investment opportunity.

Avalanche (AVAX)

Avalanche is trading between $22.26 and $29.82, holding steady above crucial support at $17.58. The coin has experienced a modest 3% rise over the past week, despite being down 10% over the month and more than 40% over the past six months. With an RSI of 57.45 indicating balanced conditions, AVAX has strong potential for a substantial rebound. If it breaks through the resistance at $32.69, AVAX could target $60.00, reflecting a potential increase of around 250% from its current high.

Render (RENDER)

Render is trading between five and seven dollars, with recent bullish activity leading to a 19% increase over the past week. The coin is approaching its ten-day average of $5.64, and with an RSI around 50, the outlook is favorable. If the positive trend continues, RENDER could reach the nearest resistance at nearly eight dollars, which could lead to a potential gain of about 220%. Over the longer term, the coin might aim for $28.00, representing a remarkable 300% increase from current levels.

Cronos (CRO)

Cronos is trading between $0.0843 and $0.0925, currently testing the resistance at $0.0964. Despite recent challenges, the RSI at 54.72 suggests potential for growth. If CRO manages to break through the resistance at $0.1046, it could aim for $0.35, reflecting a substantial potential increase of approximately 280% from its current high. With strong support at $0.0800, any positive momentum could drive CRO to impressive new heights.

Sui (SUI)

Sui is trading between 85 cents and $1.10, facing resistance at $1.20. The RSI at 54.75 indicates a balanced market with bullish potential. Despite a recent dip, Sui has risen 13.6% over the past month. If the coin breaks through the $1.20 resistance, it could target $5.00, offering a potential increase of around 350%. With support at 71 cents providing a safety net, SUI has significant potential for impressive growth, making it an enticing option for investors.

Conclusion

KAS, AVAX, RENDER, CRO, and SUI show strong potential for significant returns in September. Each has unique features that could drive growth. KAS offers innovative tech, AVAX excels in decentralized finance, RENDER provides powerful graphics solutions, CRO has solid exchange backing, and SUI focuses on new user experiences. With the start to make this article unique but mean the same thing as the original.”].0843 and [gpt_article topic=””September’s Top 5 Analyst Recommendations: Cryptocurrencies That Could Maximize Your Investment by 25x”” directives=”Format the text for embedding in a WordPress post, using HTML tags. Reword the

Looking for the next big crypto opportunity? This article delves into the top five digital currencies that could potentially amplify investments by 25 times this September. Featuring expert insights and analysis, it highlights the coins poised for dramatic growth. Discover which cryptocurrencies may skyrocket and why they stand out in the market.

Kaspa (KAS)

Kaspa is currently trading between sixteen and eighteen cents, with resistance at nineteen cents and support at fourteen cents. Despite a recent drop of approximately fourteen percent over the past month, the coin has shown a positive five percent increase recently. With moving averages stabilizing around seventeen cents and an RSI close to 70, Kaspa is primed for a potential breakout. If the bulls drive the price beyond the twenty-one cent mark, Kaspa could potentially surge by up to 275%, making it a compelling investment opportunity.

Avalanche (AVAX)

Avalanche is trading between $22.26 and $29.82, holding steady above crucial support at $17.58. The coin has experienced a modest 3% rise over the past week, despite being down 10% over the month and more than 40% over the past six months. With an RSI of 57.45 indicating balanced conditions, AVAX has strong potential for a substantial rebound. If it breaks through the resistance at $32.69, AVAX could target $60.00, reflecting a potential increase of around 250% from its current high.

Render (RENDER)

Render is trading between five and seven dollars, with recent bullish activity leading to a 19% increase over the past week. The coin is approaching its ten-day average of $5.64, and with an RSI around 50, the outlook is favorable. If the positive trend continues, RENDER could reach the nearest resistance at nearly eight dollars, which could lead to a potential gain of about 220%. Over the longer term, the coin might aim for $28.00, representing a remarkable 300% increase from current levels.

Cronos (CRO)

Cronos is trading between $0.0843 and $0.0925, currently testing the resistance at $0.0964. Despite recent challenges, the RSI at 54.72 suggests potential for growth. If CRO manages to break through the resistance at $0.1046, it could aim for $0.35, reflecting a substantial potential increase of approximately 280% from its current high. With strong support at $0.0800, any positive momentum could drive CRO to impressive new heights.

Sui (SUI)

Sui is trading between 85 cents and $1.10, facing resistance at $1.20. The RSI at 54.75 indicates a balanced market with bullish potential. Despite a recent dip, Sui has risen 13.6% over the past month. If the coin breaks through the $1.20 resistance, it could target $5.00, offering a potential increase of around 350%. With support at 71 cents providing a safety net, SUI has significant potential for impressive growth, making it an enticing option for investors.

Conclusion

KAS, AVAX, RENDER, CRO, and SUI show strong potential for significant returns in September. Each has unique features that could drive growth. KAS offers innovative tech, AVAX excels in decentralized finance, RENDER provides powerful graphics solutions, CRO has solid exchange backing, and SUI focuses on new user experiences. With the start to make this article unique but mean the same thing as the original.”].0925. As it approaches the resistance at [gpt_article topic=””September’s Top 5 Analyst Recommendations: Cryptocurrencies That Could Maximize Your Investment by 25x”” directives=”Format the text for embedding in a WordPress post, using HTML tags. Reword the

Looking for the next big crypto opportunity? This article delves into the top five digital currencies that could potentially amplify investments by 25 times this September. Featuring expert insights and analysis, it highlights the coins poised for dramatic growth. Discover which cryptocurrencies may skyrocket and why they stand out in the market.

Kaspa (KAS)

Kaspa is currently trading between sixteen and eighteen cents, with resistance at nineteen cents and support at fourteen cents. Despite a recent drop of approximately fourteen percent over the past month, the coin has shown a positive five percent increase recently. With moving averages stabilizing around seventeen cents and an RSI close to 70, Kaspa is primed for a potential breakout. If the bulls drive the price beyond the twenty-one cent mark, Kaspa could potentially surge by up to 275%, making it a compelling investment opportunity.

Avalanche (AVAX)

Avalanche is trading between $22.26 and $29.82, holding steady above crucial support at $17.58. The coin has experienced a modest 3% rise over the past week, despite being down 10% over the month and more than 40% over the past six months. With an RSI of 57.45 indicating balanced conditions, AVAX has strong potential for a substantial rebound. If it breaks through the resistance at $32.69, AVAX could target $60.00, reflecting a potential increase of around 250% from its current high.

Render (RENDER)

Render is trading between five and seven dollars, with recent bullish activity leading to a 19% increase over the past week. The coin is approaching its ten-day average of $5.64, and with an RSI around 50, the outlook is favorable. If the positive trend continues, RENDER could reach the nearest resistance at nearly eight dollars, which could lead to a potential gain of about 220%. Over the longer term, the coin might aim for $28.00, representing a remarkable 300% increase from current levels.

Cronos (CRO)

Cronos is trading between $0.0843 and $0.0925, currently testing the resistance at $0.0964. Despite recent challenges, the RSI at 54.72 suggests potential for growth. If CRO manages to break through the resistance at $0.1046, it could aim for $0.35, reflecting a substantial potential increase of approximately 280% from its current high. With strong support at $0.0800, any positive momentum could drive CRO to impressive new heights.

Sui (SUI)

Sui is trading between 85 cents and $1.10, facing resistance at $1.20. The RSI at 54.75 indicates a balanced market with bullish potential. Despite a recent dip, Sui has risen 13.6% over the past month. If the coin breaks through the $1.20 resistance, it could target $5.00, offering a potential increase of around 350%. With support at 71 cents providing a safety net, SUI has significant potential for impressive growth, making it an enticing option for investors.

Conclusion

KAS, AVAX, RENDER, CRO, and SUI show strong potential for significant returns in September. Each has unique features that could drive growth. KAS offers innovative tech, AVAX excels in decentralized finance, RENDER provides powerful graphics solutions, CRO has solid exchange backing, and SUI focuses on new user experiences. With the start to make this article unique but mean the same thing as the original.”].1046, there’s speculation that a successful breakout could propel Cronos to [gpt_article topic=””September’s Top 5 Analyst Recommendations: Cryptocurrencies That Could Maximize Your Investment by 25x”” directives=”Format the text for embedding in a WordPress post, using HTML tags. Reword the

Looking for the next big crypto opportunity? This article delves into the top five digital currencies that could potentially amplify investments by 25 times this September. Featuring expert insights and analysis, it highlights the coins poised for dramatic growth. Discover which cryptocurrencies may skyrocket and why they stand out in the market.

Kaspa (KAS)

Kaspa is currently trading between sixteen and eighteen cents, with resistance at nineteen cents and support at fourteen cents. Despite a recent drop of approximately fourteen percent over the past month, the coin has shown a positive five percent increase recently. With moving averages stabilizing around seventeen cents and an RSI close to 70, Kaspa is primed for a potential breakout. If the bulls drive the price beyond the twenty-one cent mark, Kaspa could potentially surge by up to 275%, making it a compelling investment opportunity.

Avalanche (AVAX)

Avalanche is trading between $22.26 and $29.82, holding steady above crucial support at $17.58. The coin has experienced a modest 3% rise over the past week, despite being down 10% over the month and more than 40% over the past six months. With an RSI of 57.45 indicating balanced conditions, AVAX has strong potential for a substantial rebound. If it breaks through the resistance at $32.69, AVAX could target $60.00, reflecting a potential increase of around 250% from its current high.

Render (RENDER)

Render is trading between five and seven dollars, with recent bullish activity leading to a 19% increase over the past week. The coin is approaching its ten-day average of $5.64, and with an RSI around 50, the outlook is favorable. If the positive trend continues, RENDER could reach the nearest resistance at nearly eight dollars, which could lead to a potential gain of about 220%. Over the longer term, the coin might aim for $28.00, representing a remarkable 300% increase from current levels.

Cronos (CRO)

Cronos is trading between $0.0843 and $0.0925, currently testing the resistance at $0.0964. Despite recent challenges, the RSI at 54.72 suggests potential for growth. If CRO manages to break through the resistance at $0.1046, it could aim for $0.35, reflecting a substantial potential increase of approximately 280% from its current high. With strong support at $0.0800, any positive momentum could drive CRO to impressive new heights.

Sui (SUI)

Sui is trading between 85 cents and $1.10, facing resistance at $1.20. The RSI at 54.75 indicates a balanced market with bullish potential. Despite a recent dip, Sui has risen 13.6% over the past month. If the coin breaks through the $1.20 resistance, it could target $5.00, offering a potential increase of around 350%. With support at 71 cents providing a safety net, SUI has significant potential for impressive growth, making it an enticing option for investors.

Conclusion

KAS, AVAX, RENDER, CRO, and SUI show strong potential for significant returns in September. Each has unique features that could drive growth. KAS offers innovative tech, AVAX excels in decentralized finance, RENDER provides powerful graphics solutions, CRO has solid exchange backing, and SUI focuses on new user experiences. With the start to make this article unique but mean the same thing as the original.”].35, reflecting a stunning 280% rise. With solid support at [gpt_article topic=””September’s Top 5 Analyst Recommendations: Cryptocurrencies That Could Maximize Your Investment by 25x”” directives=”Format the text for embedding in a WordPress post, using HTML tags. Reword the

Looking for the next big crypto opportunity? This article delves into the top five digital currencies that could potentially amplify investments by 25 times this September. Featuring expert insights and analysis, it highlights the coins poised for dramatic growth. Discover which cryptocurrencies may skyrocket and why they stand out in the market.

Kaspa (KAS)

Kaspa is currently trading between sixteen and eighteen cents, with resistance at nineteen cents and support at fourteen cents. Despite a recent drop of approximately fourteen percent over the past month, the coin has shown a positive five percent increase recently. With moving averages stabilizing around seventeen cents and an RSI close to 70, Kaspa is primed for a potential breakout. If the bulls drive the price beyond the twenty-one cent mark, Kaspa could potentially surge by up to 275%, making it a compelling investment opportunity.

Avalanche (AVAX)

Avalanche is trading between $22.26 and $29.82, holding steady above crucial support at $17.58. The coin has experienced a modest 3% rise over the past week, despite being down 10% over the month and more than 40% over the past six months. With an RSI of 57.45 indicating balanced conditions, AVAX has strong potential for a substantial rebound. If it breaks through the resistance at $32.69, AVAX could target $60.00, reflecting a potential increase of around 250% from its current high.

Render (RENDER)

Render is trading between five and seven dollars, with recent bullish activity leading to a 19% increase over the past week. The coin is approaching its ten-day average of $5.64, and with an RSI around 50, the outlook is favorable. If the positive trend continues, RENDER could reach the nearest resistance at nearly eight dollars, which could lead to a potential gain of about 220%. Over the longer term, the coin might aim for $28.00, representing a remarkable 300% increase from current levels.

Cronos (CRO)

Cronos is trading between $0.0843 and $0.0925, currently testing the resistance at $0.0964. Despite recent challenges, the RSI at 54.72 suggests potential for growth. If CRO manages to break through the resistance at $0.1046, it could aim for $0.35, reflecting a substantial potential increase of approximately 280% from its current high. With strong support at $0.0800, any positive momentum could drive CRO to impressive new heights.

Sui (SUI)

Sui is trading between 85 cents and $1.10, facing resistance at $1.20. The RSI at 54.75 indicates a balanced market with bullish potential. Despite a recent dip, Sui has risen 13.6% over the past month. If the coin breaks through the $1.20 resistance, it could target $5.00, offering a potential increase of around 350%. With support at 71 cents providing a safety net, SUI has significant potential for impressive growth, making it an enticing option for investors.

Conclusion

KAS, AVAX, RENDER, CRO, and SUI show strong potential for significant returns in September. Each has unique features that could drive growth. KAS offers innovative tech, AVAX excels in decentralized finance, RENDER provides powerful graphics solutions, CRO has solid exchange backing, and SUI focuses on new user experiences. With the start to make this article unique but mean the same thing as the original.”].0800, this digital asset’s connection to a major crypto exchange offers an additional layer of security for investors.

Finally, we have Sui (SUI), trading between 85 cents and .10, with experts keenly observing its battle against the .20 resistance level. Given Sui’s recent 13.6% increase, analysts believe a successful push past this barrier could send the coin as high as .00, translating to a massive 350% potential upside. With its innovative approach to enhancing user engagement and its solid baseline support of 71 cents, SUI is well-positioned to be a top performer in the coming weeks.

Risk-reward assessment for maximizing returns

Navigating the cryptocurrency market’s volatility requires a keen understanding of the risk-reward dynamics associated with each investment. For investors eyeing significant returns, the ability to balance the potential upside against inherent risks is crucial—especially in a market as unpredictable as cryptocurrencies. When evaluating options like Kaspa (KAS), Avalanche (AVAX), Render (RENDER), Cronos (CRO), and Sui (SUI), weighing the risks versus potential rewards becomes even more critical. Each of these assets presents a unique set of risk factors that could impact their performance, as well as exciting opportunities for substantial gains.

Take Kaspa (KAS) for instance. While the potential for up to 275% returns is tantalizing, this is contingent on the asset breaking significant resistance levels. Investors must consider the risk that Kaspa could stagnate or even decline if broader market conditions turn unfavorable or if it fails to maintain momentum past key technical levels. The fast-moving nature of this asset, juxtaposed against a volatile RSI, requires investors to stay vigilant and ready to adjust their positions quickly if sentiment shifts.

Similarly, Avalanche (AVAX) promises substantial rewards with its potential to reach .00—a possible 250% upside. However, AVAX has experienced significant drawdowns in the past, and any further adverse price fluctuations could pose risks. The ongoing battle between bulls and bears around key support and resistance areas requires a calculated entry point for investors. Entering this market without a well-planned exit strategy could expose investors to substantial losses.

In the case of Render (RENDER), while its unique offering in decentralized GPU rendering creates a compelling narrative, the coin is still subject to broader market volatility. The recent 19% upward movement is encouraging, but investors should consider the possibility of a retracement, especially at critical resistance points. The coin’s longer-term prospects suggest impressive gains, but this could also involve holding through potential short-term volatility, which might not be suitable for all investors.

Cronos (CRO) emerges as a strong candidate for those seeking higher returns, with predictions of a bullish run pushing the price to [gpt_article topic=””September’s Top 5 Analyst Recommendations: Cryptocurrencies That Could Maximize Your Investment by 25x”” directives=”Format the text for embedding in a WordPress post, using HTML tags. Reword the

Looking for the next big crypto opportunity? This article delves into the top five digital currencies that could potentially amplify investments by 25 times this September. Featuring expert insights and analysis, it highlights the coins poised for dramatic growth. Discover which cryptocurrencies may skyrocket and why they stand out in the market.

Kaspa (KAS)

Kaspa is currently trading between sixteen and eighteen cents, with resistance at nineteen cents and support at fourteen cents. Despite a recent drop of approximately fourteen percent over the past month, the coin has shown a positive five percent increase recently. With moving averages stabilizing around seventeen cents and an RSI close to 70, Kaspa is primed for a potential breakout. If the bulls drive the price beyond the twenty-one cent mark, Kaspa could potentially surge by up to 275%, making it a compelling investment opportunity.

Avalanche (AVAX)

Avalanche is trading between $22.26 and $29.82, holding steady above crucial support at $17.58. The coin has experienced a modest 3% rise over the past week, despite being down 10% over the month and more than 40% over the past six months. With an RSI of 57.45 indicating balanced conditions, AVAX has strong potential for a substantial rebound. If it breaks through the resistance at $32.69, AVAX could target $60.00, reflecting a potential increase of around 250% from its current high.

Render (RENDER)

Render is trading between five and seven dollars, with recent bullish activity leading to a 19% increase over the past week. The coin is approaching its ten-day average of $5.64, and with an RSI around 50, the outlook is favorable. If the positive trend continues, RENDER could reach the nearest resistance at nearly eight dollars, which could lead to a potential gain of about 220%. Over the longer term, the coin might aim for $28.00, representing a remarkable 300% increase from current levels.

Cronos (CRO)

Cronos is trading between $0.0843 and $0.0925, currently testing the resistance at $0.0964. Despite recent challenges, the RSI at 54.72 suggests potential for growth. If CRO manages to break through the resistance at $0.1046, it could aim for $0.35, reflecting a substantial potential increase of approximately 280% from its current high. With strong support at $0.0800, any positive momentum could drive CRO to impressive new heights.

Sui (SUI)

Sui is trading between 85 cents and $1.10, facing resistance at $1.20. The RSI at 54.75 indicates a balanced market with bullish potential. Despite a recent dip, Sui has risen 13.6% over the past month. If the coin breaks through the $1.20 resistance, it could target $5.00, offering a potential increase of around 350%. With support at 71 cents providing a safety net, SUI has significant potential for impressive growth, making it an enticing option for investors.

Conclusion

KAS, AVAX, RENDER, CRO, and SUI show strong potential for significant returns in September. Each has unique features that could drive growth. KAS offers innovative tech, AVAX excels in decentralized finance, RENDER provides powerful graphics solutions, CRO has solid exchange backing, and SUI focuses on new user experiences. With the start to make this article unique but mean the same thing as the original.”].35. However, this optimistic scenario is balanced by the risk of failure to break through immediate resistance levels. Exchange-linked tokens like CRO can be particularly susceptible to shifts in exchange policies or broader market sentiment, adding another layer of complexity to the risk-reward equation.

Finally, Sui (SUI) offers the promise of a 350% return, should it manage to break its .20 resistance and ascend towards .00. While these returns are possible, investors must weigh this against the inherent risks of investing in newer, less-established cryptocurrencies. Early-stage projects often come with heightened risk, including potential liquidity challenges and market unpredictability, even for those with strong technical foundations.

Each of these cryptocurrency assets presents a high-reward opportunity, but not without corresponding risks. Investors need to carefully evaluate their risk tolerance and investment timelines. Positions should ideally be scaled, and potential exit points identified to lock in profits and mitigate losses. Balancing these elements could be key to maximizing returns while minimizing exposure to the unpredictable nature of the crypto markets.

Expert tips for timing your crypto investments

Proper timing can make or break a cryptocurrency investment, and understanding how to time your entry and exit points is critical for anyone looking to maximize returns. Cryptocurrencies are notably volatile, with prices often experiencing dramatic swings within short periods. This makes timing an essential factor in capturing gains as well as minimizing losses. Here are essential timing strategies that experts recommend to optimize your investment outcomes.

First, it’s crucial to keep an eye on broader market trends, including Bitcoin’s performance, as it often sets the tone for the entire crypto market. A bull run in Bitcoin typically leads to gains across various altcoins, while a downturn can result in widespread sell-offs. Therefore, identifying the start of a Bitcoin uptrend can offer a favorable entry point for many altcoins, including those highlighted in this article. Conversely, if Bitcoin shows signs of weakness or enters a bearish phase, it may be prudent to hold off on new investments or consider taking profits in smaller altcoins before they follow suit.

Secondly, monitoring key technical indicators like RSI (Relative Strength Index), moving averages, and volume trends is essential. These indicators provide insights into market sentiment and potential reversal points. For instance, a cryptocurrency with an RSI above 70 might be in overbought territory, signaling a possible pullback. Conversely, an RSI below 30 could indicate a buying opportunity, as the coin might be oversold. Using these technical indicators in conjunction with support and resistance levels can help you identify optimal buying or selling points.

Another critical aspect of timing your investments is understanding and anticipating market cycles. The cryptocurrency market often moves in cycles, including accumulation, uptrend, distribution, and downtrend phases. Identifying which phase the market or a particular asset is in can provide valuable context for your timing decisions. For example, purchasing an asset during the accumulation phase, where the price tends to be stable or slightly up-trending, can position you for significant gains during the subsequent uptrend. On the other hand, selling during the distribution phase, where the asset may be reaching its peak price, allows you to lock in profits before a potential downtrend.

Beyond technical analysis, staying updated with fundamental developments is also essential. News regarding technological upgrades, partnerships, or regulatory changes can have a profound impact on short-term and long-term price action. Monitoring such events can offer clues on upcoming price movements, helping you adjust your strategy accordingly. For example, if a major upgrade or partnership is announced for one of the cryptocurrencies you’re holding, it might be a good time to buy before the price increases. Conversely, if regulatory news negatively impacts the market, being prepared to exit before prices decline can protect your investments.

Additionally, being mindful of market liquidity and trading volumes is vital. High liquidity indicates that you’re more likely to execute buys or sells at your desired price without significant slippage. Low liquidity, particularly in smaller or lesser-known cryptocurrencies, can lead to price slippage and increased volatility, making timing even more crucial. Trading volume trends can provide an early signal for larger price moves, offering insights into when to enter or exit a trade.

Lastly, diversification is a strategy that should not be underestimated. Even with the best timing, it’s challenging to predict the market’s every move. By spreading your investments across multiple cryptocurrencies, you can mitigate risks while capturing growth opportunities. As discussed earlier in this article, diversifying into assets like Kaspa, Avalanche, Render, Cronos, and Sui could position you well to maximize rewards while managing broader market risks.

While timing is undoubtedly critical, it should be used in conjunction with a broader investment strategy. Combining market analysis, technical indicators, an understanding of market cycles, and diversification can help you make more informed timing decisions. By taking a calculated approach, you stand a better chance of optimizing your returns in the ever-volatile world of cryptocurrency investing.

Written by Julien – France AMbassador

Written by Julien – France AMbassador

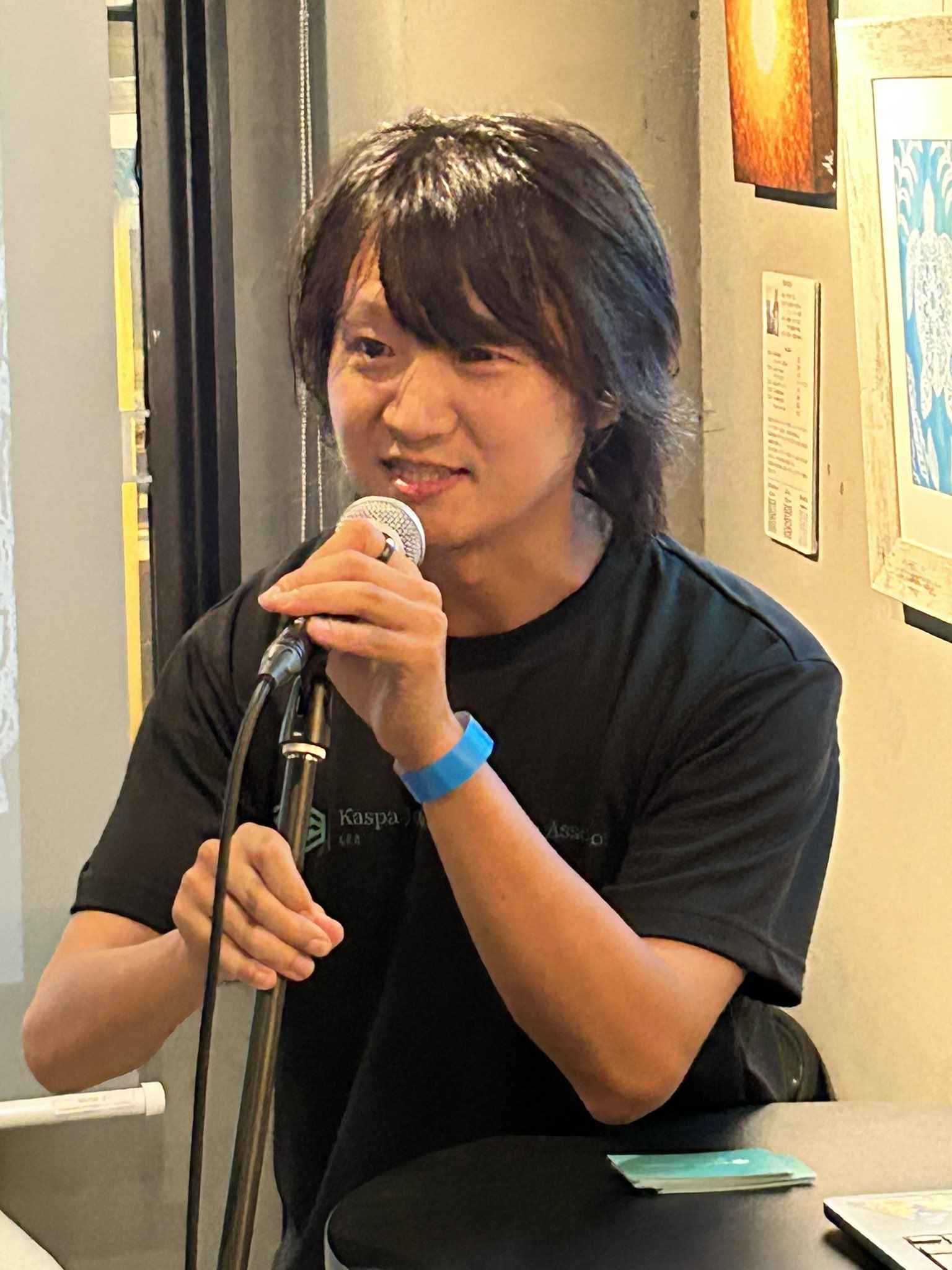

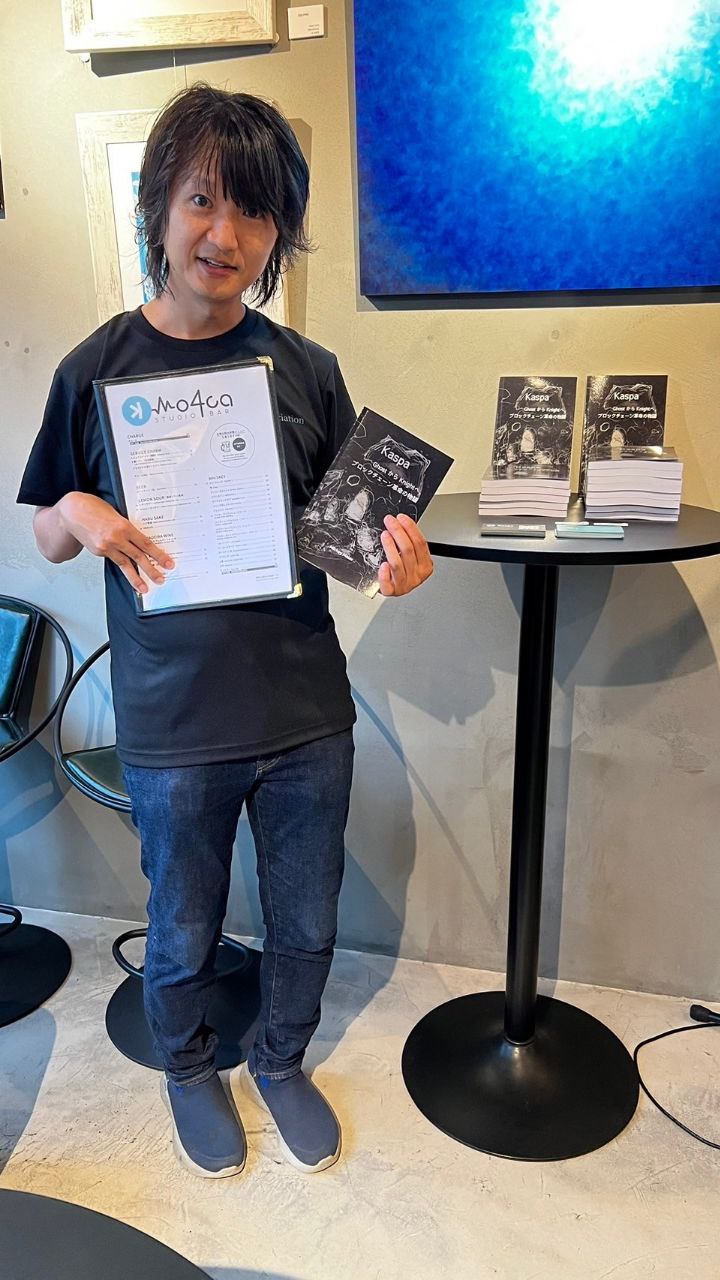

Written by Bitmo: Japan Ambassador

Written by Bitmo: Japan Ambassador