Oct 29, 2024 | News

zdex’s growth potential and market outlook

ZDEX’s growth potential has captivated the attention of top analysts, as the token continues to make waves in the decentralized finance (DeFi) space. As of now, ZDEX is positioned as a highly promising investment opportunity that analysts believe could achieve exponential returns, as high as 500x, by the first quarter of 2025. This level of projected growth could outstrip other popular tokens, including Kaspa (KAS) and Toncoin (TON), which have garnered their own considerable attention in the crypto sphere. However, ZDEX’s capability to integrate cutting-edge technologies and innovative features into its ecosystem sets it apart from the competition.

The success of ZDEX is largely attributed to its symbiotic relationship with ZircuitDEX, a decentralized exchange that delivers unprecedented speed and efficiency due to its native layer-2 scaling solution on the Zircuit L2 chain. This unique infrastructure allows for ultra-fast transaction speeds with negligible fees, creating a seamless user experience that appeals to both veteran and new DeFi participants. As the DeFi landscape evolves and the next bull cycle approaches, investors are increasingly looking for platforms that not only promise exceptional growth but also deliver in terms of technology and usability—two key factors ZDEX excels in.

What makes ZDEX’s journey particularly compelling is its low current entry price, making it accessible to a broader range of potential investors. With a price still under [gpt_article topic=”Top Analysts Forecast ZDEX Could Achieve 500x Growth by Q1 2025, Outshining KAS and TON” directives=”Format the text for embedding in a WordPress post, using HTML tags. Reword the

ZDEX Presale: Your Golden Ticket to DeFi Glory

The ZDEX presale is currently live, presenting a unique opportunity to invest in the next big thing in the world of decentralized finance (DeFi). With a starting price of $0.0017, ZDEX is gaining momentum rapidly, outpacing even the most popular meme coins. By getting in early, investors can position themselves for significant gains in the upcoming bull market. Analysts predict that ZDEX will lead the way among DEX tokens, with potential returns of over 1,000%!

🏎️💨 Swap faster than ever with ZircuitDEX 🏎️💨

ZDEX is the core of ZircuitDEX, a cutting-edge decentralized exchange (DEX) built on the lightning-fast Zircuit L2 chain. With its lightning-quick swaps, minimal slippage, near-zero fees, and user-friendly interface, ZircuitDEX caters to all levels of DeFi traders who are looking to maximize their gains in the next bull run.

ZircuitDEX is fully EMV-compatible, making it easy to integrate with Ethereum tools. Additionally, its use of ZK proofs ensures top-notch security, even in the most challenging market conditions!

🚀 Enjoy steady profits with meme coins on ZircuitDEX 🚀

Remember when BRETT skyrocketed by 14,000%? With ZircuitDEX’s meme coin launchpad, you can be an early adopter of the next big meme token sensation. ZircuitDEX’s community-first approach and meme-powered atmosphere make DeFi an exciting and profitable journey right from the start!

🌕 Watch your capital grow with ZircuitDEX 🌕

Whether you’re swapping assets or providing liquidity, ZircuitDEX is designed to maximize your profits while keeping things simple and automated. With its concentrated liquidity feature, ZircuitDEX offers up to 500 times more capital efficiency compared to other DEX platforms. This means that liquidity providers can earn more with less capital. Additionally, ZircuitDEX’s automated liquidity strategies take the hassle out of trading, allowing you to sit back, relax, and watch your gains multiply.

As excitement continues to build, smart investors seeking the next 100X token are flocking to the ZDEX presale. Token holders not only gain access to governance rights but also enjoy exclusive airdrops, trade incentives, and staking rewards.

>>> Don’t settle for average! Get your ZDEX tokens now and join the revolutionary world of ZircuitDEX! <<<

Site: ZircuitDEX

Twitter: https://x.com/ZircuitDEX

Telegram: https://t.me/ZircuitDexVerify

Kaspa: A High-Speed Proof-of-Work Cryptocurrency with BlockDAG Technology

Kaspa is a proof-of-work cryptocurrency that utilizes the GHOSTDAG protocol, enabling parallel block creation and consensus-based ordering. Unlike traditional blockchains, Kaspa’s blockchain operates on a blockDAG (Directed Acyclic Graph) structure, which enhances scalability and reduces confirmation times. Currently processing one block per second, Kaspa aims to increase its throughput to 10 or even 100 blocks per second. Kaspa also incorporates features like Reachability for querying the DAG’s topology, block data pruning, SPV proofs, and plans for subnetwork support to facilitate future layer 2 implementations. These innovations make Kaspa an intriguing technology in the world of cryptocurrencies, particularly for those interested in scalable and efficient proof-of-work systems.

Toncoin: A Decentralized Layer-1 Blockchain with Promising Potential

Toncoin (TON) serves as the native cryptocurrency of The Open Network, a decentralized, open-source layer-1 blockchain supported by the TON Foundation and community contributors. Initially developed by Telegram as the Telegram Open Network with the ‘Gram’ token, the project was discontinued in 2020 due to an SEC court order. Since then, the TON Foundation and community enthusiasts have taken charge of the development. Toncoin adopts a proof-of-stake consensus model, to make this article unique but mean the same thing as the original.”].01 during its presale stage, the opportunity for early birds to realize significant capital gains is immense. As liquidity continues to flow into the DeFi sector, the demand for efficient token swaps, advanced liquidity strategies, and secure transactions is likely to witness a sharp incline. ZDEX, by positioning itself as an all-in-one ecosystem solution, aims to capture a substantial share of this prospective market surge.

Furthermore, the token’s projected rise is backed by a range of diversified revenue streams that are not solely dependent on the volatile nature of DeFi trends. By integrating features like automated liquidity management and rewards for liquidity providers, ZDEX lays down a reliable structure for sustainable growth. Also, with upcoming features that include staking incentives and exclusive NFT releases, the ecosystem continuously adds value to token holders, ensuring long-term investor retention and engagement.

In comparing the growth potential of ZDEX to its peers, including KAS and TON, ZDEX presents a far more integrated and cohesive platform that covers a wider range of functionalities within the DeFi world. KAS focuses primarily on transaction scalability, while TON’s ambitions lie in establishing a comprehensive Web3 ecosystem. ZDEX, in contrast, leverages the best of these areas while standing out due to its emphasis on creating immediate, practical use cases for all levels of investors. This multifaceted approach underlines ZDEX’s unique value proposition, promising a more lucrative and exciting journey for those that decide to hold on as it scales to its full potential.

how zdex compares to kas and ton

When assessing how ZDEX stacks up against Kaspa (KAS) and Toncoin (TON), it’s essential to analyze their core technologies, market positions, and growth trajectories. Though each project holds promise in its own right, ZDEX’s unique architecture and comprehensive DeFi offerings provide several advantages over its peers.

Kaspa offers groundbreaking innovation through its BlockDAG structure, which significantly improves transaction throughput compared to traditional blockchains. With its goal of processing up to 100 blocks per second, KAS is certainly making waves in the proof-of-work (PoW) arena. However, its PoW consensus mechanism comes with inherent limitations, such as energy consumption and scalability challenges when compared to proof-of-stake (PoS) or more modern consensus algorithms. Kaspa’s strength lies in its scalability and efficiency in transaction validation but lacks the broader ecosystem and application-focused growth that tokens like ZDEX aim to achieve.

Toncoin (TON), on the other hand, has a strong background originating from Telegram’s The Open Network. Toncoin builds on a PoS consensus algorithm, allowing it to deliver faster processing speeds and lower energy consumption compared to traditional PoW networks like Kaspa. It also boasts a strong goal of enabling decentralized applications, cross-chain interoperability, and a comprehensive Web3 ecosystem. While TON has the infrastructure in place for long-term scalability and usability in decentralized applications, its ecosystem is still in its development stage, and it has yet to achieve the level of liquidity and immediate utility that ZDEX has showcased through ZircuitDEX.

In contrast, ZDEX, with its integration into the ZircuitDEX ecosystem, brings an immediate, user-focused platform that caters to a diverse range of crypto needs—from decentralized trading and automated liquidity management to meme coin launches and governance capabilities. While Kaspa and Toncoin focus primarily on solving scalability and interoperability concerns, ZDEX offers real-time, usable features within a live platform. ZDEX not only addresses transaction speed and reduced fees but also provides tools that support liquidity providers, meme coin enthusiasts, and traders looking for advanced, automated strategies.

Furthermore, ZDEX’s use of a layer-2 scaling solution on the Zircuit L2 chain positions it strongly in the highly competitive DeFi market. With near-instant transaction confirmation (compared to Kaspa’s eventual goal of 100 blocks per second) and minimal fees, ZDEX beats both Kaspa and Toncoin in day-to-day usability for traders. Moreover, ZDEX plans to offer staking incentives, exclusive NFT drops, and other DeFi rewards, making it more attractive not just for developers but also for casual investors who seek passive income from staking and liquidity provision.

While Kaspa and Toncoin undoubtedly offer innovative features catered to their respective niches, ZDEX’s extensive range of functionalities, immediate real-world use cases, and its focus on making decentralized finance accessible to all levels of investors give it an edge in the race. The blend of a scalable DeFi platform with modern meme coin culture gives ZDEX the potential to appeal to a broader audience, both as a novel tech innovation and as a living, breathing ecosystem with practical utility. As a result, investors looking for rapid growth with tangible reasons for that growth might find ZDEX to be the more compelling opportunity compared to KAS or TON.

key factors driving zdex’s projected rise

Several critical factors are driving ZDEX’s projected meteoric rise, reflecting the breadth of its technological advancements, ecosystem growth, and strategic positioning within the decentralized finance (DeFi) landscape.

At the core of this anticipated success is ZircuitDEX, which utilizes state-of-the-art layer-2 scaling solutions on the Zircuit L2 chain. This enables ultra-fast transactions with minimal fees, effectively addressing a significant pain point in the DeFi space: the high fees and congestion often seen on layer-1 platforms like Ethereum during periods of high demand. Moreover, the platform’s EVM compatibility ensures a smooth integration with other prominent Ethereum-based applications, providing an even larger user base for ZDEX to grow within.

Another driving force behind ZDEX’s growth is its commitment to security. The use of zero-knowledge (ZK) proofs ensures that transactions remain private and secure, even in tumultuous market conditions. The security framework not only gives users added confidence but also positions ZDEX as an ideal platform for institutional investors who seek safety along with performance. This layer of trust further solidifies ZDEX’s long-term staying power in the DeFi market.

Beyond technical prowess, ZDEX has also created multiple revenue streams to diversify its growth. Key features such as its automated liquidity management strategies and concentrated liquidity pools allow liquidity providers to earn more with less capital, ensuring that even smaller investors can turn a profit. This makes ZDEX a more sustainable option compared to many competing DeFi platforms that are entirely reliant on transaction fees or volatile tokenomics. The ecosystem also encourages broader participation through staking, governance, and community-driven initiatives, perpetuating a cycle of growth by offering users multiple ways to engage with the platform beyond simple trading.

What further distinguishes ZDEX from other DeFi tokens is its ability to tap into the lucrative meme coin market. ZircuitDEX’s meme coin launchpad is designed to attract the next generation of viral meme tokens, replicating the 14,000% gains seen by past meme coin projects like BRETT. By catering to both serious DeFi traders and meme coin enthusiasts, ZDEX captures an exceptionally wide audience, which accelerates its growth potential.

In addition, ZDEX leverages a robust marketing strategy targeting both retail investors and institutional participants. Strategic partnerships and influencer-driven campaigns are already raising awareness about the platform even during its presale phase. Marketing efforts are geared towards creating long-lasting brand equity for ZDEX as a reliable, go-to DeFi solution, which is not only technologically superior but also fun and accessible.

One of the most compelling elements fueling ZDEX’s projected success is its willingness to adapt as the market evolves. While many DeFi tokens are locked into fixed narratives, ZDEX maintains a fluid and evolving roadmap that can quickly incorporate new features based on community feedback and market trends. Already, there are plans for staking incentives, exclusive NFT releases, trade incentives, and real-time governance, which ensures that the platform remains competitive in the rapidly changing DeFi landscape.

ZDEX’s blend of lightning-fast transactions, enhanced security protocols, creative revenue streams, and adaptable infrastructure sets the stage for its remarkable ascent. Combined with its retail-friendly meme coin launchpad and strategic vision, ZDEX is primed to lead the DeFi space into its next growth phase, with analysts confidently pointing to a 500x surge by early 2025.

expert predictions for q1 2025

The growing community of crypto analysts, traders, and investors is buzzing about what could be one of the largest breakout tokens in the market by 2025 — ZDEX. According to leading experts, the platform’s existing trajectory suggests it could see up to 500x gains by Q1 2025. Several factors have led these top analysts to this projection, including ZDEX’s current performance, technological backbone, ecosystem features, and the overall DeFi market trends.

Central to this prediction is ZDEX’s integration into ZircuitDEX, which enables real-world, everyday utility through ultra-efficient decentralized trading and liquidity management. This functionality has already captured a sizable user base, supporters of which believe ZDEX could very well dominate the DeFi space during the next market cycle. What further fuels these projections is the innovative “meme coin” potential within ZircuitDEX, which people can access via its meme coin launchpad. By appealing to both casual and institutional investors, ZDEX diversifies its supporter base, improving its longevity and potential for massive growth.

Additionally, institutional support is predicted to play a considerable role in ZDEX’s explosive rise. Major industry players are already showing interest in layer-2 solutions, zero-knowledge proofs, and decentralized finance applications — all areas where ZDEX excels. This gives ZDEX an appealing edge when it comes to partnering with larger financial entities looking to gain exposure in DeFi. Experts point to past behaviors of institutional investors entering markets like Bitcoin and Ethereum only after an uptrend begins, suggesting once ZDEX solidifies its market presence, these bigger players might follow, likely pushing ZDEX prices even higher into 2025.

Analysts are also focusing on user adoption rates for DeFi platforms in general. With DeFi adoption projections continuing to rise quarter over quarter, ZDEX, as a token deeply integrated into a rapidly scalable DEX platform, stands to benefit immensely from this industry-wide trend. Its multiple-use applications, varying from highly efficient liquidity pools to meme coin ecosystems, create natural “stickiness” that ensures users and liquidity providers remain actively engaged. This could easily lead to exponential growth akin to what successful tokens like UNI or SUSHI have experienced in earlier DeFi cycles.

While 500x is an aggressive target, these experts argue that it is not without precedent. As recent as 2021, tokens within similar decentralized ecosystems have not only hit but far surpassed similar projections. With the infrastructure, user engagement, and scalability of ZDEX already in place, there is ample reason to believe that such impressive growth could be on the horizon.

Experts are closely observing ZDEX’s performance within both technical and social spaces, including its engagement with the NFT and meme coin communities and its efficient, low-fee DEX ecosystem. Provided these factors align, many see a strong likelihood that ZDEX could emerge as one of the most lucrative DeFi investments leading into 2025, with 500x returns becoming a tangible target for early and savvy investors.

Oct 27, 2024 | News

Expert insights on SOL: a powerhouse in DeFi

In the rapidly evolving landscape of decentralized finance (DeFi), Solana (SOL) has gained substantial recognition as a blockchain platform pushing the boundaries of scalability and speed. Originally launched in 2020, Solana has since become a significant player in DeFi, rivaling more established names like Ethereum thanks to its high-performance capabilities. Experts have weighed in, highlighting its ability to handle tens of thousands of transactions per second (TPS), which makes it one of the fastest blockchain networks available today. This level of throughput enables users and developers alike to engage with decentralized applications (dApps) without the bottlenecks often experienced on slower networks.

What makes Solana so appealing to the developer community is its unique architecture, which prioritizes both speed and efficiency. Unlike Ethereum, which relies on layer-2 solutions or sharding to enhance scalability, Solana uses a combination of proof-of-history (PoH) and proof-of-stake (PoS) consensus mechanisms. PoH timestamps transactions to verify when they occurred, while PoS enables validators to process them quickly. This blend eliminates the need for complex solutions to achieve high scalability. Solana’s TPS is unrivaled by most projects in the industry, far surpassing Ethereum’s current capability.

Beyond its performance, the Solana network is also known for its low fees. With transaction costs typically amounting to fractions of a penny, developers and users find the platform highly cost-effective. This is a significant advantage in the DeFi space, where networks that charge excessively high fees have been a drawback for both institutional and retail investors. Solana has thus removed considerable friction from the DeFi ecosystem by allowing more economical and practical operations on its network.

Another key factor in Solana’s strong market presence is the growing ecosystem that has sprouted around its native token, SOL. SOL functions as the lifeblood of the network, facilitating various financial transactions, staking, and governance processes. With SOL, users can stake their holdings to earn rewards or use them to power decentralized applications on the platform. At its core, SOL’s utility lies in securing the entire Solana network, which is essential to maintaining the platform’s decentralized structure and operational efficiency.

In terms of adoption, Solana has been embraced by several major DeFi projects, including decentralized exchanges (DEXs), lending platforms, and NFT marketplaces. This favorability is largely attributed to its capacity for handling thousands of smart contracts simultaneously in a reliable and scalable manner. As a result, some analysts believe Solana could further challenge Ethereum’s dominance as new projects look for more scalable, cost-effective solutions to build on.

The SOL token’s price has witnessed significant growth in 2021 and 2022, and though the crypto market has experienced a broader downturn, industry pundits still see Solana as a long-term asset with strong fundamentals. Its innovative technical framework, coupled with its compelling value proposition in DeFi, has positioned it as a major contender in the altcoin market. Whether for application development or long-term holding, Solana continues to be a formidable presence in the world of decentralized finance.

CYBRO: the rising star in AI-driven blockchain

CYBRO’s rise to prominence in the crypto space heralds a new era for blockchain with artificial intelligence (AI) driving its core functionalities. This innovative platform, promising high returns and revolutionary technology, is poised to disrupt the decentralized finance (DeFi) landscape. At the heart of CYBRO’s appeal is its seamless integration of AI into blockchain mechanics, creating a system that learns and adapts to market conditions, optimizing yield strategies autonomously. For investors, this means CYBRO can not only navigate today’s volatile market but also innovate continuously by adapting to emergent trends, ensuring maximal profitability.

The presale success, amassing over million, is only a small indicator of the growing interest in CYBRO. What makes it particularly attractive is that it offers investors a chance to tap into an intelligent DeFi platform before it officially launches, providing a first-mover advantage. AI-driven algorithms identifying market inefficiencies are becoming increasingly essential as the crypto space expands. CYBRO’s utilization of this cutting-edge technology enables its ecosystem to compile vast amounts of data in real time, rapidly adjusting investment strategies to yield better results for its community members. Compared to ‘static’ DeFi protocols, CYBRO’s dynamic system represents the future of blockchain-driven finance.

One of the key uses for CYBRO’s AI is automating the process of identifying optimal staking opportunities across multiple crypto platforms based on liquidity, yield, and risk assessment. By leveraging AI, users can significantly reduce the time and expertise traditionally required to make profitable decisions in a decentralized financial ecosystem. As it functions with minimal manual input, CYBRO decreases human-introduced errors while enhancing returns in real-time. Moreover, users can trust that the platform will continuously learn and adapt, providing increasingly sophisticated predictive models for asset staking and liquidity mining.

Beyond the financial advantages, CYBRO’s AI integration also offers unique technological innovations. The platform’s smart contracts are designed to self-execute, managing and allocating resources without human intervention. Additionally, AI enhances the security of these contracts by identifying potential vulnerabilities or inefficiencies that could compromise user assets. As the platform grows, it’s expected that the AI elements will become more integral to identifying and responding even faster to cybersecurity threats, positioning CYBRO as a leader not just in performance but safety as well.

In a broader context, CYBRO represents the next evolutionary phase of decentralized finance: combining AI with blockchain’s secure, transparent, and immutable nature. This merging of technologies allows for a self-sustaining ecosystem where the strength of mathematical models fuels innovation and profitability—something that investors in the crypto space have been eagerly anticipating.

KAS: breaking new ground with innovative consensus

KAS has been making headlines as an innovative player in the cryptocurrency world, redefining the proof-of-work (PoW) consensus mechanism with its revolutionary GHOSTDAG protocol, a major departure from traditional blockchain structures. While typical blockchains work by selecting a single chain of valid blocks, discarding others that may have been mined simultaneously, GHOSTDAG allows multiple blocks to coexist and orders them in a consensus without discarding any. This makes Kaspa uniquely positioned to avoid blockchain performance bottlenecks that occur in systems where only a single valid chain is maintained.

One of the standout features of Kaspa is its scalability, even within the PoW framework, which is often criticized for being slow and resource-intensive. The introduction of the GHOSTDAG protocol supercharges the typical PoW process by enabling very high block creation rates while keeping transaction finality times to a minimum. This enables the Kaspa network to theoretically support an enormous number of transactions per second, without sacrificing decentralization or security.

Currently, Kaspa’s block rates stand at 1 per second, significantly faster than what is typically seen in PoW systems like Bitcoin, which processes a block approximately every 10 minutes. What’s even more remarkable is that Kaspa’s team aims to push this to 10 blocks per second in the near future. This increase in throughput would make the network suitable for highly scalable applications and services that require high-speed transactions.

Another innovative feature embedded in Kaspa is its block data pruning capabilities, where the network removes non-critical information to keep system storage requirements manageable. It’s expected that future optimizations will include the application of block header pruning to further increase the efficiency and scalability of the network. For users and developers, this makes Kaspa an attractive option, as it can maintain high throughput rates without an excessive burden on the network’s nodes.

The addition of Reachability—a feature that enables nodes and users to query the network’s topology to easily track transaction paths within the DAG—is another innovation that positions Kaspa at the forefront of next-gen blockchain solutions. What’s more, the platform is set to implement support for subnetworks, laying the groundwork for future layer-2 solutions that can interact seamlessly with the Kaspa mainnet while leveraging its high-speed and secure infrastructure.

Kaspa’s robust technology and the high-level security features inherent to PoW—paired with its dramatic improvements in speed and scalability—open up new possibilities for decentralized applications (dApps) and real-world blockchain utilization. As such, many analysts consider the KAS token as a game-changer in the cryptocurrency space, and its use within high-frequency, high-interaction environments could be pivotal for the ongoing adoption of blockchain technology.

AAVE’s strong position in the lending sector

Aave has secured its place as one of the foremost decentralized lending platforms within the cryptocurrency industry. Running on the Ethereum blockchain, Aave enables peer-to-peer lending and borrowing of various crypto assets without needing traditional financial intermediaries. This decentralized protocol allows users to deposit funds into liquidity pools, from which others can borrow by providing collateral, ensuring that no counterparty risk is involved in the process.

One of the key features that set Aave apart from other lending platforms is its introduction of flash loans—a groundbreaking DeFi innovation that allows users to borrow funds without providing collateral, as long as the loan is repaid within the same transaction. These are unique because they must be executed quickly, within a single Ethereum block (roughly 12 to 15 seconds long). Flash loans are particularly useful for arbitrage opportunities across different trading platforms, whereby users can exploit price discrepancies between markets or correct leverage positions without locking in liquidity for long periods.

Aave also supports lending and borrowing across a number of assets, including popular cryptocurrencies such as ETH, DAI, and USDT, giving users broad flexibility in managing their portfolios. Borrowers can choose between stable and variable interest rates, depending on their risk tolerance and the nature of their financial needs. The rates are calculated algorithmically, based on supply and demand within the protocol, ensuring token holders always have the chance to optimize their yields.

In addition to conventional lending and borrowing, Aave introduces advanced features like rate switching, where borrowers can shift between fixed and floating interest rate models based on what they perceive as most advantageous given market conditions. Borrowers also benefit from Aave’s collateralized debt positions (CDPs), ensuring there are guarantees in place for lenders, making the protocol safer and more reliable.

The Aave ecosystem relies heavily on its native governance token, AAVE. Token holders can participate in governance voting, deciding on key changes or updates to the platform. This decentralized decision-making structure ensures that every improvement to the protocol aligns with the consensus views of the platform’s stakeholders, making Aave a user-driven endeavor. Holding AAVE tokens also yields financial benefits; for instance, stakers contribute to the security of the system and, in return, receive staking rewards.

Aave’s innovative approach to decentralized finance, the breadth of asset availability, and user-centric features have secured its position not only as a leader in DeFi but also as a potential benchmark for future decentralized lending protocols. As the Aave protocol continues to expand, including the upcoming launch of Aave V3—which promises cross-chain capabilities and improved capital efficiency—it remains a key platform that draws substantial investor and developer attention.

>>>Explore Aave Today and Unlock the Power of Decentralized Lending<<<

Oct 24, 2024 | News

solana whales monitor rising interest in dogen

Solana whales, known for their sizable stakes and strategic investments, have been keeping a close watch on the rising momentum behind DOGEN, a new memetoken that’s been creating serious buzz in the crypto space. As the DOGEN presale escalates, some of the largest holders on Solana are sitting back in silence, speculating on whether this promising memetoken could become the next big opportunity in the market. With its presale numbers already soaring to impressive heights, it’s clear that DOGEN has caught the attention of not only individual investors but also large-scale holders who often have a significant impact on token prices through their market-moving trades.

While traditionally, whales in any blockchain ecosystem have been cautious about deploying their capital into memecoins—often considered speculative—DOGEN’s rapid presale success suggests it could break that mold. This growing interest is not just about the token’s meme appeal; it’s driven by DOGEN’s unique positioning and the potential for explosive returns, particularly in a market where community-driven tokens often witness massive growth in short periods.

Whales understand the power of early entry, and DOGEN’s rise presents an opportunity to leverage their resources in a nascent project with major upside potential. Given that Solana itself has been a pioneer in handling decentralized applications at scale, integrating native memecoins such as DOGEN could solidify Solana’s leadership in this niche, bringing even more attention and liquidity to the platform. The connection between whale interest and the success of tokens cannot be understated; when capital-rich players begin to open up positions, it often sets off a cascade of broader mainstream interest.

For now, these whales appear to be waiting for the right moment. Some might be looking for clarity on DOGEN’s roadmap, while others assess the token’s scalability and community engagement. However, if DOGEN continues on its upward trajectory, it’s likely only a matter of time before these heavyweight investors start to make their moves, further fueling the excitement surrounding the token.

the appeal of dogen in the memecoin landscape

One of the primary factors driving DOGEN’s rise in the memecoin landscape is its ability to break through a saturated market where many competitors offer little apart from short-lived hype. DOGEN has quickly distinguished itself with a blend of strong meme power and strategic utility, making it attractive not simply as a “pump-and-dump” token but as an asset that brings longevity and value to its holders. This distinction is key in a world where community-driven cryptos can either fade into obscurity or dominate for months, sometimes even years. By creating a robust community structure and tactical presale incentives, DOGEN has captured the zeitgeist of modern meme culture while also appealing to experienced crypto traders who look for more than just short-term gains.

Another component of DOGEN’s appeal lies in its branding and market positioning. Memecoins thrive not only on their utility but also on their story and identity. Dogecoin’s initial success was attributable largely to strong meme culture; Shiba Inu benefitted from a viral community ethos. DOGEN draws upon this same spirit but ups the ante with its “alpha male” branding that resonates with a subset of the market tapped into luxury and aspirational lifestyles. The branding as a token for those who “demand the best” hits a demographic that is not only active in meme culture but also has the disposable income from previous gains in the altcoin space. This sense of exclusivity, paired with the promise of financial prosperity, is exactly what memecoins targeting high-end crypto influencers and investors capitalizing on hype cycles need to take off.

Additionally, the timing of DOGEN’s launch couldn’t be better. With a resurging interest in the memecoin sector, partially driven by the success of other tokens like Shiba Inu and Floki, DOGEN enters the fray at a moment when investors are eager for the next big bet. The token taps into a narrative that has been growing stronger every year: the fusion of crypto eccentricity (as seen in meme culture) and serious financial opportunity. This intricate combination helps DOGEN stand out from more traditional financial assets, especially as it highlights an altcoin season where market veterans are seeking to diversify into high-risk, high-reward opportunities.

But what truly differentiates DOGEN is its presale strategy. Many memecoins adopt a scattershot approach, but DOGEN’s presale design, with its multilayered referral system and exclusive perks, has created an early demand frenzy that can’t be ignored. As more investors pile in early, the token potentially sets itself up to reach critical mass before even hitting the broader exchanges. Early adopters who latch onto the token during the presale experience both the value boost and the unique prestige that comes with getting in before the masses.

By fostering both strong community engagement and a mindset where ownership of DOGEN is a status symbol — combining financial gain and social currency — the token is rapidly embedding itself as a game-changer in the memecoin landscape. This fresh angle on memecoins makes DOGEN appealing to a broader swath of the market, from casual crypto enthusiasts looking for fun in their investments to serious traders watching for explosive growth.

comparison to kaspa and toncoin: unique traits of dogen

When comparing DOGEN to contenders like Kaspa and Toncoin, it’s evident that DOGEN brings a unique set of traits that make it stand out in the crowded crypto space. Both Kaspa and Toncoin have made significant strides in their respective niches — with Kaspa focusing on high-speed proof-of-work mechanisms and Toncoin offering advanced layer-1 infrastructure backed by a famous origin story, stemming from its early development by the team behind Telegram. However, despite their solid technological foundations, neither Kaspa nor Toncoin has managed to capture the emotional and cultural hype that DOGEN has stirred within such a short timeframe.

Kaspa’s GHOSTDAG-powered BlockDAG technology offers significant improvements in blockchain efficiency — enabling faster, more scalable transactions — but it remains primarily a technical solution to a blockchain problem. It appeals primarily to developers, tech enthusiasts, and crypto users concerned with security and speed. While these are crucial aspects, the average memecoin buyer isn’t necessarily focused on the underlying tech. Instead, they want immediate gains and the thrill of quick success stories, something DOGEN capitalizes on spectacularly. By tapping into smooth, effortless participation through its easy-to-understand presale model, DOGEN ensures that anyone with a little knowledge of crypto can get involved — with the promise of thousand-percent returns.

Toncoin, on the other hand, shines due to its decentralized proof-of-stake model and its association with Telegram’s massive user base. While Toncoin does have its spotlight moments — especially within the Telegram ecosystem — its use case is largely seen as one within the payments and service sectors of decentralized products. This gives it a more institutional appeal but doesn’t harness the viral spread of pop culture that DOGEN does. Where Toncoin is building infrastructure for long-term, decentralized applications, DOGEN is charging ahead with a promise of quick returns, driven by a community of meme-loving enthusiasts who create their own momentum virally.

DOGEN’s connection to meme culture, blended with strategic financial incentives, places it in an entirely different league than both of its competitors. Memecoins have a history of generating explosive returns seemingly out of nowhere. This can be traced back to Dogecoin’s initial moonshot, followed by Shiba Inu and Floki. What sets DOGEN apart is not just its meme power, but also the way it has engineered the exclusivity factor, making holders feel a part of an elite club. Kaspa and Toncoin, while solid technological achievements, inherently lack that kind of community-driven frenzy that pushes tokens into the mainstream at rocket speed.

Furthermore, DOGEN banks on smart tokenomics that create a ripple effect throughout its ecosystem. The incentivized referral system, something Kaspa and Toncoin lack, not only builds an engaged user base but also turns early adopters into evangelists who actively promote the token. While infrastructure coins like Kaspa and Toncoin focus on solving long-term, real-world technology and decentralization issues, DOGEN zeros in on the primal aspect that drives most of memecoin success: hype, urgency, and community loyalty.

Given its unique positioning within the rapidly evolving memecoin market and its ability to fuse meme culture with genuine financial prospects, DOGEN offers something its competitors can’t: a chance to be more than just a fast transaction method or a decentralized ledger. DOGEN is about status, identity, and a financial adventure. This makes it equally attractive to novice crypto buyers and seasoned traders hunting for the next big thing in speculative assets. In this form, DOGEN’s unique traits set it up to potentially overtake both Kaspa and Toncoin in terms of market buzz and user appeal.

could dogen surpass its competitors in market dominance?

As DOGEN continues to gain momentum in its presale, a pertinent question remains: could it actually surpass memecoins like Kaspa and Toncoin in terms of market dominance? The answer lies in understanding both the cryptoeconomic landscape and the psychology of crypto investors. While each project offers distinct strengths, memecoins—historically—operate in a unique bubble where community, narrative, and viral growth often overpower technological finesse.

Kaspa and Toncoin, despite their undeniable strengths, may not have the same viral capacity for community-driven growth that DOGEN does. Kaspa’s focus on high-speed proof-of-work through BlockDAG technology appeals to users who prioritize technological innovation and scalability in their blockchain solutions. Similarly, Toncoin’s appeal largely stems from its deep roots in Telegram’s ecosystem and its focus on providing efficient, decentralized services. Both coins, though strong in niche sectors, cater more to developers and long-term use cases. This focus on infrastructure rather than speculative dynamics can limit their appeal to a broader investor base seeking short-term, high-yield opportunities — the exact audience that DOGEN is targeting.

DOGEN’s presale strategy, combined with its meme-centric culture, is set to attract a massive following of retail investors who are increasingly driven by FOMO (fear of missing out). Where Kaspa and Toncoin are focused on solving and improving blockchain technology, reliability, and decentralization — DOGEN is focused purely on delivering an adrenaline-pumping, high-risk/high-reward financial experience with a disruptive marketing approach that speaks directly to a modern, online culture. This alone gives DOGEN massive potential to eclipse its rivals when it comes to retail market buzz.

Furthermore, while the long-term economic models of Kaspa and Toncoin may seem more stable and grounded in utility, DOGEN’s allure is in its explosiveness. Early adopters have the potential to see enormous gains almost overnight as demand spikes for what is quickly becoming one of the most sought-after memecoins in the space. In the cryptosphere, timing is everything, and DOGEN’s strategic presale, referral system, and community-building efforts have perfectly positioned it to capitalize on the current altcoin bull market. For this reason, DOGEN could easily leap ahead in short-term market capitalization before more technologically advanced tokens like Kaspa and Toncoin even begin to catch up.

Another factor to consider is the branding and market penetration of memecoins. Where Kaspa and Toncoin emphasize their decentralized infrastructure, DOGEN is built on cultural relevance — a potent cocktail of humor, meme power, and aspirational branding. In a market where virality often trumps utility, DOGEN’s ability to tap into meme-driven marketing is likely to create tidal waves across the crypto sphere. This virality — combined with its focus on cultivating an “exclusive alpha lifestyle” — ensures that its primary investors are not just buying a coin, but buying into a movement, a culture. This is something that neither Kaspa nor Toncoin has been able to achieve on a mainstream scale.

While it remains to be seen whether DOGEN will maintain longevity, its meteoric rise has already placed it in a strong position to challenge its competitors for market dominance, at least in terms of short-term popularity and quick gains. Kaspa and Toncoin may thrive in more technologically mature sectors of the market, but DOGEN has built all the right pieces to become the headline-grabbing memecoin of this cycle. Its trajectory could eventually establish it as a top-tier player in the meme-coin ecosystem, capable of toppling more established and technology-heavy tokens, if it can sustain its current momentum and navigate market saturation effectively.

Oct 24, 2024 | News

Altcoins on the rise: a brief overview of current trends

As the cryptocurrency market continues to mature, a growing number of altcoins are emerging as significant players, challenging Bitcoin’s historically dominant position. While Bitcoin remains the most valuable and well-known cryptocurrency, driving much of the public’s understanding and interest in the digital economy, altcoins have found their niche by offering diverse functionalities and use cases that expand far beyond Bitcoin’s original vision of decentralized peer-to-peer transactions.

In recent times, the surge in decentralized finance (DeFi) platforms, play-to-earn games, and non-fungible tokens (NFTs) has pushed several altcoins into the spotlight. Coins such as Ethereum (ETH), Solana (SOL), and Binance Coin (BNB) have demonstrated sustained growth by introducing innovative blockchain ecosystems and applications that cater to these rapidly burgeoning sectors. Unlike Bitcoin, which primarily functions as a store of value, many of these altcoins serve as the backbone for entire decentralized applications (dApps), smart contracts, and NFTs, enabling users to execute sophisticated digital agreements and trade digital goods securely.

Data from various crypto market analysis platforms shows that while Bitcoin’s return on investment (ROI) since inception is impressive, the ROI for some of these altcoins over shorter time periods has been higher. For instance, in 2021 and 2022 alone, coins such as Solana saw unprecedented percentage gains, outpacing Bitcoin during key growth periods. Ethereum, with its shift towards Ethereum 2.0 and the upcoming potential for reduced transaction fees and increased scalability, remains a strong contender, driving the growth of DeFi and NFT sectors.

Several key trends are currently affecting the performance and adoption of altcoins. The growing consumer and corporate interest in decentralized applications, combined with the rise of decentralized autonomous organizations (DAOs), has fueled the development and integration of altcoins. Furthermore, a global push towards greener, more sustainable blockchain solutions is influencing investor interest. Bitcoin, still reliant on energy-intensive mining practices, is being challenged by altcoins such as Cardano (ADA) and Polkadot (DOT), which utilize proof-of-stake (PoS) mechanisms or alternative consensus algorithms designed to reduce the environmental impact of securing their networks.

The demand for faster transaction speeds coupled with lower costs has also led to the rise of Layer 2 solutions and blockchain interoperability, allowing diverse blockchain systems to communicate seamlessly with one another. Projects like Polygon (MATIC) have capitalized on this trend, extending the functionality of Ethereum while still benefiting from its security. In the case of cross-chain technology, ecosystems like Cosmos (ATOM) and Polkadot actively work on improving connectivity between isolated blockchains, further enhancing their viability as long-term alternatives to scaled-up Bitcoin usage.

Even meme coins like Dogecoin (DOGE) and Shiba Inu (SHIB) have attracted immense attention, largely due to their communities and support from high-profile figures. Though often dismissed as speculative investments, these meme-based altcoins remind investors of the sometimes unpredictable nature of market movements, especially within the cryptocurrency space.

The market capitalization of altcoins as a collective is only increasing, and their utility as part of the overall digital financial landscape is becoming more evident. Their ability to branch out into multiple sectors of daily life, commerce, legal agreements, gaming, and social interactions exemplifies the diverse avenues that decentralized technologies can explore—far beyond what Bitcoin set out to achieve over a decade ago. However, with increased volatility and evolving global regulations, the journey for altcoins is as complex as it is exciting for investors and developers alike.

Key factors driving altcoin performance

Several important factors contribute to the varying performance levels of altcoins in today’s cryptocurrency market. While Bitcoin continues to dominate with its established reputation and first-mover advantage, altcoins are drawing interest due to their distinct value propositions and technical innovations. Understanding these crucial drivers can shed light on why certain altcoins are gaining ground against Bitcoin and could potentially outperform it in the coming years.

One of the primary factors behind the rise of altcoins is technological advancements. Many altcoins offer unique features and capabilities that Bitcoin lacks, such as smart contracts, decentralized finance (DeFi) functionality, and enhanced transaction speeds. Ethereum, for instance, has become the go-to blockchain for decentralized applications (dApps) due to its programmable smart contract functionality. This has allowed it to maintain a significant position in the market as Bitcoin’s major competitor, particularly as the Ethereum 2.0 upgrade aims to reduce gas fees and improve scalability. Solana, with its proof-of-history (PoH) mechanism, offers faster and cheaper transactions, making it another favorite in the DeFi and NFT ecosystems. Such technological progress gives these altcoins a distinct edge when users prioritize capabilities that extend beyond Bitcoin’s role as a store of value.

The second key factor is the growing interest in specialized use cases for blockchain technology. Altcoins often serve specific niches within the broader crypto world, catering to various industries ranging from finance and gaming to supply chain management. For example, Binance Coin (BNB) has primarily gained traction because of its widespread use within the Binance ecosystem, including discounted trading fees and access to its decentralized exchange. Likewise, tokens like Axie Infinity (AXS) have made a name for themselves by powering play-to-earn games, tapping into a growing sector where gaming enthusiasts can benefit financially from their participation, creating new income streams.

Altcoin performance is also closely tied to institutional and retail adoption. While Bitcoin is considered digital gold and is being increasingly adopted by institutions as a hedge against inflation, altcoins are embraced for their versatile applications, bridging the gap between cryptocurrency and traditional business models. Projects like Chainlink, which offers decentralized oracle services, are gaining institutional interest for their ability to integrate with traditional data sources and automate payment systems. As more institutions and enterprises explore using blockchain for real-world applications, altcoins that provide essential infrastructure and services are likely to experience increased long-term demand. Furthermore, many blockchain platforms are actively seeking partnerships with traditional industries, as seen with VeChain’s collaborations in the supply chain sector—a move that significantly boosts the value of the associated token.

Another pivotal factor is regulatory developments. Governments worldwide are slowly developing frameworks for crypto regulation, which can make or break specific projects. Bitcoin, as the oldest and most well-known blockchain, often falls under less stringent scrutiny compared to newer altcoin projects, which may require additional compliance due to their advanced features and engagement with traditional finance. Altcoins that proactively work within regulatory frameworks—such as Cardano’s focus on building a highly secure and regulation-friendly blockchain—are positioning themselves as safer investments in the eyes of regulators and institutions. Altcoins that thrive under regulations are more likely to see strong future growth, as they offer assurances to both governments and investors.

Community engagement and decentralized governance mechanisms also play a critical role in altcoin success. Many promising altcoins involve their communities directly in the decision-making process, encouraging governance through token-based voting systems. Projects like Uniswap with its UNI token stand out by allowing holders to influence the direction of the protocol, leading to stronger user loyalty and a sense of ownership among participants. As decentralized platforms grow and become increasingly user-driven, altcoins with robust governance models are more likely to maintain long-term user engagement and attract new participants.

Beyond technical and regulatory aspects, an essential differentiator between Bitcoin and emerging altcoins is the shift towards environmental sustainability. Bitcoin’s proof-of-work (PoW) mining process has come under fire due to its significant energy consumption, leading eco-conscious investors to explore greener alternatives. Altcoins like Ethereum (once fully adopting proof-of-stake in its 2.0 iteration), Cardano, and Tezos offer more energy-efficient consensus mechanisms which support a global call for the reduction of blockchain’s carbon footprint. These greener protocols are likely to gain increased attention as environmental concerns continue to influence economic and political policies.

Lastly, the role of market sentiment and media attention can never be underestimated in the crypto space. Memes and celebrity endorsements—such as Elon Musk’s famous Twitter endorsements of coins like Dogecoin—can trigger frenzied buying sprees, significantly influencing short-term performance, even for fundamentally weaker projects. Though such movements are often dismissed as speculative, they underscore the importance of the social element in cryptocurrency investments.

When assessing altcoin performance, these interconnected factors provide a clearer understanding of why certain projects have a competitive edge. Altcoins continue to evolve with incredible speed, propelled by breakthroughs in technology, increasing institutional interest, and favorable regulation, while social and environmental concerns further reshape the crypto landscape.

Major market challenges for altcoins versus bitcoin

As altcoins continue to gain ground against Bitcoin, they face their own set of challenges that could influence their long-term growth and adoption. While both altcoins and Bitcoin operate in the same ecosystem, their development trajectories hinge on a series of unique hurdles, each with the potential to impact their market performance.

One of the prominent challenges for altcoins is their relative instability and volatility. Though Bitcoin certainly experiences price fluctuations, its historical value and reputation lend it more stability compared to many altcoins. Altcoins, by contrast, are often more susceptible to rapid shifts in market sentiment, driven by factors such as technological updates, regulatory news, or even rumors in the crypto community. For example, Ethereum’s price movement has been closely tied to updates about Ethereum 2.0, while newer projects like Solana saw significant volatility in response to development hiccups and network downtime. This market instability makes it harder for altcoins to serve as reliable stores of value, positioning them more as speculative investments than Bitcoin, which is often viewed as “digital gold.”

Another core issue facing altcoins is security vulnerability. Bitcoin, with its robust, well-tested proof-of-work (PoW) mechanism and secure network, has managed to fend off serious threats, establishing trust over its long lifespan. In contrast, many altcoins that utilize newer consensus mechanisms, such as proof-of-stake (PoS) or delegate PoS, are under increased scrutiny for potential weaknesses. The complexity of their networks, combined with frequent upgrades and rapidly evolving technological features, introduces fresh points of failure. For example, smart contract vulnerabilities in ecosystems such as Ethereum have resulted in significant financial losses over the years. Flash loan attacks and complex exploits in DeFi protocols built on altcoin networks are also troubling for new investors, as such vulnerabilities expose risks that could hamper the overall reputation of the altcoin market.

Scalability remains a persistent challenge for the broader cryptocurrency space, and altcoins are no exception. While many altcoins were introduced as alternatives capable of outpacing Bitcoin’s capacities, especially concerning transaction speed and cost, even top-performing projects like Ethereum and Solana occasionally encounter scalability issues. Congested networks lead to slower transaction speeds, higher gas fees, or even significant outages. For instance, Ethereum’s high gas fees continue to be a thorn in its side during periods of heightened network activity, such as during the rush to buy popular NFTs. Although Layer 2 solutions and parallel chain technologies are emerging to address scalability, the complexity of introducing such upgrades without triggering system failure or user inconvenience is a key challenge altcoins must overcome to compete effectively with Bitcoin while addressing users’ transactional needs.

Regulatory pressure also looms large over the altcoin market. Despite significant strides made by governments and regulators concerning Bitcoin, many altcoins—especially those involved in decentralized finance (DeFi) or projects offering privacy features—are encountering stricter regulatory scrutiny. Uncertainty in regulation presents a challenge for altcoins that operate in specific niches of the blockchain ecosystem. DeFi projects, for instance, are often subject to concerns about transparency, money laundering, and unregistered securities, with some governments moving to introduce tighter controls. Unlike Bitcoin, which has largely avoided these issues due to its passive role as a store of value, altcoin projects that engage in more complex and provocative financial services find themselves in what is increasingly becoming a regulatory gray area. Additionally, privacy-centric altcoins like Monero or Zcash face extra hurdles, as stricter regulations on privacy coins continue to close the gap between decentralization and government oversight.

Bitcoin benefits significantly from its first-mover advantage, a quality that continues to present an enormous marketing and conventional headstart over even the most promising of altcoins. Many retail and institutional investors are drawn to Bitcoin simply for its name recognition, association with the beginnings of the cryptocurrency movement, and the existing financial products tied to it, such as Bitcoin futures and ETFs. Altcoins, on the other hand, often require educational efforts to explain their use cases and potentials to investors unfamiliar with the technical intricacies that differentiate one project from another. Moreover, Bitcoin’s value has been ingrained in the public narrative for over a decade, and it is often seen as the “safe bet” when it comes to dipping one’s toes into crypto. Altcoins, however, need to climb steeper hills to prove their worth and illustrate their distinct potential to investors and the public.

Altcoins additionally struggle with a perception of market saturation. Since the inception of Bitcoin, thousands of cryptocurrencies have been introduced, with many offering only minor technical variations or outright clones with no distinguishing innovations. This oversupply creates a noisy and confusing marketplace, making it difficult for even high-quality projects to gain the traction they need. Investors are shell-shocked by the sheer number of projects competing for attention, leading to a “crowding out” effect where promising altcoins might not receive the recognition they deserve. Furthermore, this leads to the rise and fall of many altcoins that are purely speculative, with investors hopping from one speculative asset to another in search of quick gains, creating a cycle of volatility that erodes trust in the wider altcoin space.

Finally, interoperability between multiple blockchains remains a technical hurdle that most altcoins have yet to fully address. Although platforms like Polkadot are actively working on facilitating cross-chain communication, many altcoins exist in isolation with limited interaction. Bitcoin’s established network effect makes it less reliant on external communication, while altcoins that operate on smaller ecosystems find scaling tougher without fully developed interoperability solutions. Until some of these blockchains establish more robust cross-chain bridges, their usability and liquidity will remain limited, restricting further market adoption.

In sum, the ultimate success of altcoins in outperforming Bitcoin by 2026 will depend on how adeptly they can navigate volatility, security issues, scalability, and regulatory compliance. While Bitcoin’s dominance is waning in percentage terms as more altcoins make their way into the market, there are clear obstacles—the mitigation of which will determine whether altcoins become long-lasting fixtures in the cryptocurrency space or fade into the background as fleeting trends.

Top altcoin contenders to watch by 2026

Several altcoins are poised to challenge Bitcoin’s dominance by 2026. As investors diversify their portfolios beyond Bitcoin, these emerging assets could potentially offer substantial returns, driven by their unique innovations, partnerships, and use cases. The following altcoins are considered major contenders by analysts

.

Ethereum (ETH)

Ethereum has always been the top contender to Bitcoin, largely due to its unmatched smart contract functionality. Ethereum is the backbone for much of the decentralized finance (DeFi) ecosystem and non-fungible token (NFT) platforms, facilitating dApps of various kinds. As Ethereum transitions fully to a proof-of-stake (PoS) protocol with Ethereum 2.0, the platform aims to resolve scalability and high transaction fee issues, positioning itself as a go-to platform for developers and institutions looking to build decentralized solutions.

The anticipated reduction in gas fees and environmental impact makes Ethereum a leading blockchain for enterprises and developers looking to combat Bitcoin’s slower, more resource-heavy network. Additionally, Ethereum’s Layer 2 solutions, like Polygon (MATIC), further enhance its scalability and utility, keeping Ethereum relevant even amidst the rise of alternative smart contract platforms like Solana and Binance Smart Chain.

Solana (SOL)

Solana has quickly risen to prominence thanks to its high throughput and low-cost transactions, making it a favorite for DeFi projects and NFT minting. With a theoretical capacity of handling more than 50,000 transactions per second, Solana solves many of the throughput issues that plague older blockchains such as Ethereum. Solana’s proof-of-history (PoH) mechanism effectively prevents network congestion while maintaining low fees, allowing it to operate smoothly even during periods of high demand.

The ecosystem has attracted significant interest from developers and investors alike, with a range of dApps and NFT projects choosing to deploy on Solana due to its superior performance metrics. Although it was temporarily weighed down by network outages, Solana’s team has moved quickly to address these issues, securing its place as one of the fastest-growing blockchain platforms in the crypto space.

Cardano (ADA)

Cardano continues to gain momentum as an energy-efficient alternative to Bitcoin and Ethereum. Built upon a scientific methodology and peer-reviewed research, Cardano has attracted a high degree of institutional interest, particularly as global entities seek greener technologies for blockchain applications. Cardano’s proof-of-stake consensus mechanism ensures a much lower environmental footprint compared to Bitcoin’s proof-of-work (PoW), and the eventual rollout of smart contract capabilities marks a significant upgrade to its network utility.

Scalability remains one of Cardano’s key selling points, particularly with its Hydra layer set to enhance transaction speeds as the network scales. Coupled with a focus on democratized governance through its Project Catalyst initiative, Cardano stands to benefit from a decentralized infrastructure that promotes sustainable growth and innovation in the long run.

Polkadot (DOT)

One of the most interesting players in the altcoin market, Polkadot aims to achieve a multi-chain framework that allows diverse blockchains to interact with one another seamlessly. This cross-chain functionality enables different applications, financial products, and assets to communicate across previously isolated blockchains, creating a more integrated and interoperable blockchain ecosystem.

Polkadot’s unique use of parachains—independent chains that run alongside the main Polkadot relay chain—enables the network to offer greater scalability and efficiency than many of its counterparts. Additionally, Polkadot has a robust governance mechanism allowing DOT token holders to vote on protocol upgrades and changes, ensuring the project’s development trajectory aligns with community and institutional needs alike.

Avalanche (AVAX)

Avalanche has positioned itself as a scalable and versatile blockchain platform specializing in decentralized applications and financial products. It owes its popularity in part to its near-instantaneous transaction finality, often processing around 4,500 transactions per second. The platform fosters DeFi growth and has cemented its place as one of Ethereum’s biggest competitors due to its high performance and lower transaction fees.

Given its compatibility with Ethereum-based applications via its Avalanche-Ethereum Bridge (AEB), Avalanche offers developers a seamless migration pathway from Ethereum to its network. This, combined with its unique consensus mechanism that guarantees low latency and high throughput, has helped Avalanche gain significant traction, making it a strong candidate to outperform Bitcoin in niche markets.

Polygon (MATIC)

Serving as a Layer 2 solution, Polygon works to enhance Ethereum’s scalability and usability by providing faster transactions and lower gas fees for Ethereum-based applications. While not an “Ethereum killer,” Polygon’s role as a scaling solution ensures that it will continue to play an integral role in Ethereum’s ecosystem as well as the broader blockchain industry. With growing partnerships—including with high-profile names like Disney—Polygon solidifies its place as a critical infrastructural layer for the Ethereum network and beyond.

Polygon’s robust development team continues to add features such as zk-rollups and plasma chains to boost its efficiency further, indicating that this altcoin program could see a prominent rise in value through to 2026.

In conclusion, the list of contenders above embodies the vast array of innovation taking place in the cryptocurrency world, each offering unique solutions to the traditional scaling, security, and governance problems inherent in blockchain technology. Although Bitcoin remains the most well-known and valuable cryptocurrency, it’s becoming increasingly clear that it won’t be the only or even dominant one for much longer depending on the continued advancements these altcoins exhibit over the next few years

.

Oct 24, 2024 | News

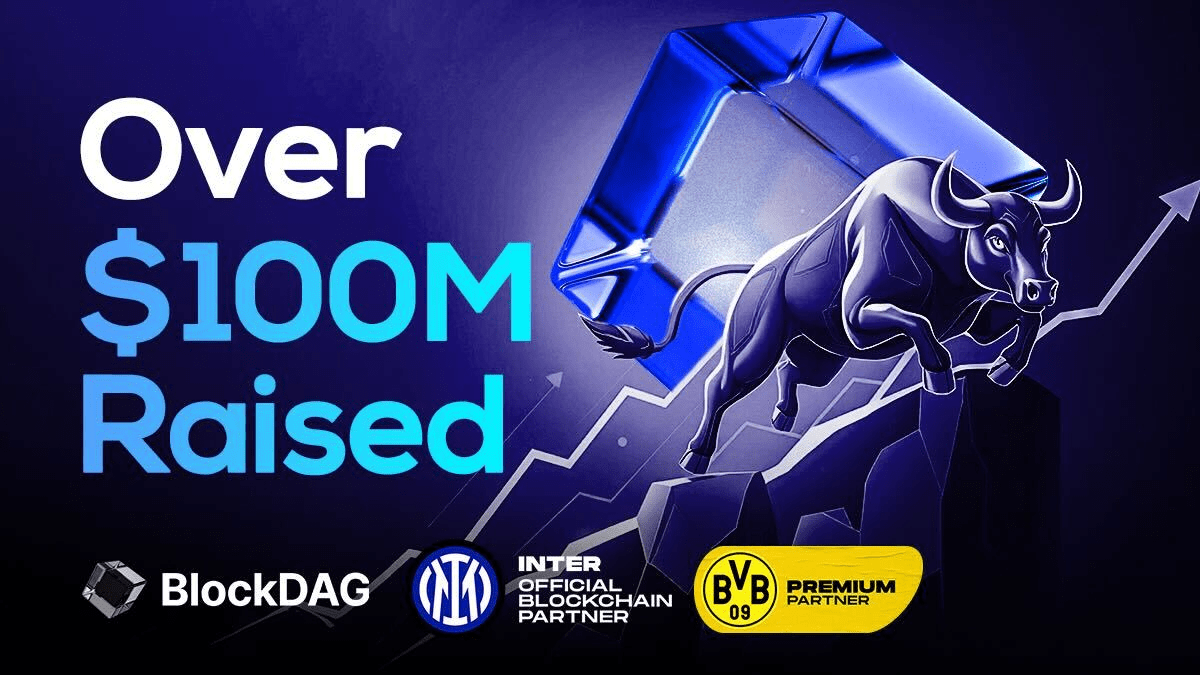

BlockDAG leads successful presale

BlockDAG Dominates Presale with a Record-Breaking 1.3 Million Raised

BlockDAG (BDAG) has captured the attention of the crypto community with its astounding achievement of raising 1.3 million during its presale, spread across 24 rounds. This has firmly established BlockDAG as the top cryptocurrency contender, outshining recent updates from projects like Ethereum and Binance Coin (BNB). With the release of its testnet, which has garnered widespread recognition for its blazing speed and enhanced security, BlockDAG is now seen as a possible rival to blockchain powerhouses like Kaspa and Solana. Investors who identified this early trend have already enjoyed staggering returns of up to 1960%, solidifying BlockDAG’s meteoric rise in the cryptocurrency ecosystem.

Innovative technology driving interest

The surge of interest in BlockDAG can largely be attributed to the novel technology underpinning the project, which sets it apart from conventional blockchain models. BlockDAG leverages a new approach, blending the advantages of Directed Acyclic Graph (DAG) architecture with enhanced consensus algorithms, enabling almost limitless scalability and transaction speeds not seen in most traditional Proof-of-Work (PoW) or even Proof-of-Stake (PoS) blockchains. This hybridized technology gives it the edge over bottlenecked networks like Ethereum, which have had to deal with high gas fees and transaction delays, or Solana, which has faced network outages in the past.

BlockDAG’s architecture provides a significant technological breakthrough: instead of transactions being processed one by one in a linear chain, BlockDAG enables parallel processing of transactions, allowing for an unprecedented increase in throughput. This keeps the network speedy, reliable, and agile, even as the user base and transaction volume grow. For users and developers, this translates to faster confirmation times and lower fees, key features that have driven massive interest and adoption.

Furthermore, BlockDAG was designed with robust security measures to prevent both 51% attacks and the double-spending problem, common concerns among blockchain projects. These security layers make it highly resilient to malicious actors, instilling confidence in both retail and institutional investors looking for a safe and scalable solution. The blend of scalability, speed, and strong security has placed BlockDAG on the radar of savvy investors and tech enthusiasts alike, further fueling its mainstream adoption.

Additionally, BlockDAG is compatible with Ethereum Virtual Machine (EVM), making it easier for developers currently working on Ethereum-related projects to transition to BlockDAG without having to start from scratch or modify their existing code significantly. This seamless migration path positions BlockDAG as an attractive alternative for Ethereum-based applications, especially as developers and users seek solutions that offer better performance without being constrained by Ethereum’s throughput issues.

The introduction of BlockDAG’s Testnet on September 20, 2024, surfaced waves of excitement among tech analysts and developers alike. With real-time transaction monitoring, smart contract testing capabilities, and its EVM compatibility, the testnet provided tangible proof of BlockDAG’s technological prowess. The ability to track and witness transactions unfold in real time with such efficiency demonstrates the maturity of the project’s infrastructure, further adding credibility to the contributions of the team behind it.

All of these technical advancements are not merely theoretical but have been put to the test with highly promising results shown during both the presale and initial testnet. As a result, the project has caught the eye of significant investors and major Ethereum and Binance Coin holders, many of whom are looking to diversify into emerging tech ecosystems that prioritize speed, security, and future scalability.

Ethereum and BNB investors embrace transition

The cryptocurrency landscape is constantly evolving, and both Ethereum and Binance Coin investors are taking notice of the progressive technological advancements delivered by BlockDAG, marking a compelling opportunity for diversification. Ethereum, which has historically been the go-to platform for decentralized applications and DeFi projects, has faced growing scrutiny due to its scalability challenges, high gas fees, and occasional network congestion. While Ethereum has made significant strides by transitioning to a Proof-of-Stake (PoS) consensus algorithm through its highly anticipated upgrades, the limitations of its original structure continue to motivate some to explore faster, more technical solutions.

For many Ethereum validators and long-time holders, BlockDAG offers an intriguing alternative. As their network continues to grow, Ethereum developers and stakeholders are recognizing the appeal of BlockDAG’s architecture, which promises unparalleled scalability and strong security mechanisms. Not only are validators seeking to maximize their returns beyond Ethereum’s ecosystem, but DeFi developers are intrigued by BlockDAG’s potential to support high-speed transactions at much lower fees, a notable pain point within Ethereum’s environment.

Likewise, Binance Coin, widely recognized for its robust utility within the Binance Smart Chain (BSC) and Binance’s extensive ecosystem, finds itself at the crossroads with the rise of competitive alternatives like BlockDAG. Although Binance Coin has seen a recent bullish surge, BlockDAG’s novel technical solutions and future scalability promise a strong appeal for BNB investors. The ability to maintain network efficiency while scaling and handling substantial transaction volumes is particularly attractive for users familiar with BNB’s neck-and-neck competition with Ethereum over throughput and transaction efficiency.

Another significant factor for both Ethereum and BNB investors is BlockDAG’s Ethereum Virtual Machine (EVM) compatibility. This enables developers to migrate their projects seamlessly from the Ethereum blockchain to BlockDAG’s infrastructure—without the need for extensive code rewriting. This crucial functionality fosters a smooth transition for developers looking to continue leveraging Ethereum-based tools and smart contracts, but with the added benefits of lower costs and greater speed offered by BlockDAG. It’s especially appealing for developers whose projects are limited by Ethereum’s current bottlenecks or are seeking more flexibility in gas-fee management.

For Binance Coin holders, the efficiency improvements assured by BlockDAG’s architecture are another draw, particularly for those managing significant trades and smart contracts through the Binance ecosystem. The growing interest in alternative blockchain solutions mirrors the strategic decisions of savvy BNB investors who see BlockDAG not simply as an investment opportunity but as a mechanism to enhance the overall user and developer experience.

In particular, institutional investors with holdings in both Ethereum and Binance are closely monitoring BlockDAG and its market movement. By getting involved early, they aim to mitigate risks associated with Ethereum’s potential delays in next-phase upgrades or BNB’s price volatility. This strategic hedging has led to increased acquisition of BDAG tokens as part of a broader portfolio strategy seeking high-growth, yet technologically robust, crypto projects.

Ultimately, this shift in attention among both Ethereum validators and BNB holders speaks to the changing tides within the crypto world, where fast, scalable, and secure infrastructures are driving market sentiment. The traction BlockDAG is generating has undeniably tapped into the hopes of those seeking to ride the wave of next-generation blockchain solutions, making it evident that BlockDAG’s rising influence is not confined to a niche—it’s transforming major crypto circles.

BlockDAG’s vision for the future of crypto

BlockDAG’s long-term vision is clear: to redefine the way blockchain infrastructures are designed and operated. At its core, BlockDAG seeks to solve the scalability trilemma—a persistent challenge in the blockchain world—with a revolutionary approach that doesn’t sacrifice decentralization or security for performance. The team behind BlockDAG is laser-focused on creating a network that can handle an ever-expanding array of decentralized applications (dApps), Web3 services, and cross-chain solutions, all while maintaining robust security protocols and lightning-speed transactions.

One of the cornerstones of BlockDAG’s roadmap is its approach to scalability, which aims to sustainably support tens of thousands of transactions per second (TPS) while preserving decentralization, a feat that has eluded many older blockchain models. Unlike some networks that have had to make significant trade-offs between speed and decentralization, BlockDAG’s underlying architecture is built to scale indefinitely using its Directed Acyclic Graph (DAG) structure, which facilitates parallel transaction processing. This positions BlockDAG as a key player in the drive towards mass adoption of blockchain solutions in industries ranging from fintech and supply chain management to gaming and the metaverse.

BlockDAG also envisions a future deeply rooted in cross-chain interoperability. Recognizing that the future of blockchain will not be dominated by a single network but a multitude of interconnected chains, the team is working on integrated solutions that allow seamless interaction with other major blockchains. Through the use of compatibility layers, such as its Ethereum Virtual Machine (EVM) compatible technology, BlockDAG aims to eliminate friction between different blockchain ecosystems, making it easy for developers and users to shift resources and applications across networks without the typical delays or high fees. This focus on interoperability ensures that BlockDAG remains relevant in an increasingly interconnected blockchain world, where the ability to execute cross-chain transactions could become a critical differentiator.

Another key aspect of BlockDAG’s vision is community engagement and decentralization governance. While the project has made impressive strides with its innovative technical framework, the team understands that mass adoption will only come if they can build a strong, decentralized governance model, empowering their token holders to participate actively in shaping the network’s future. Plans for implementing a decentralized autonomous organization (DAO) structure are in the works, allowing BDAG holders to vote on proposals related to network upgrades, token utility adjustments, and key funding allocations. By enabling token holders to have a say in the development direction of the project, BlockDAG aims to create a sovereignty network where no single entity controls the decision-making process.

In terms of wider applicability, BlockDAG is laying the groundwork for enterprise-level adoption. With an eye toward industries that require high throughput and security, such as finance, healthcare, and government services, BlockDAG’s technology is being designed to support highly scalable systems in these sectors. Its real-world use cases could eventually extend to facilitating cross-border payments, creating decentralized digital identities, and securing confidential data. The project’s vision includes partnering with institutions and enterprises to bring blockchain technology to the forefront of global commerce and governance.